“There is no denying that the Bitcoin network consumes a substantial amount of energy, but this energy consumption is what makes the Bitcoin network so robust and secure.”

Conclusion

This report took a quantitative approach, comparing Bitcoin’s energy usage to that of other industries. In the interest of an honest conversation, we also discussed why the value of Bitcoin is not just quantitative.

Subjective views on the Bitcoin network’s importance vary, but Bitcoin’s properties do not. Anyone can use Bitcoin. Anyone can hold bitcoins for themselves. And Bitcoin transactions can provide probabilistically final settlement in an hour, 24 hours a day, 365 days per year.

These features can offer financial freedom to people around the world without the luxury of stable and accessible financial infrastructure. The network can benefit the energy sector by creating perfect use cases for intermittent and excess energy. And the network will only scale further if network adoption warrants it.

Energy utilization is not necessarily a bad thing. As Smil writes, energy is the only universal currency. Humans will continue to find new technologies that require more energy that challenge the status quo. Bitcoin is yet another example.

So, if we return one last time to the original question:

“Is the Bitcoin network’s electricity consumption an acceptable use of energy?”

Our answer is definitive: yes.

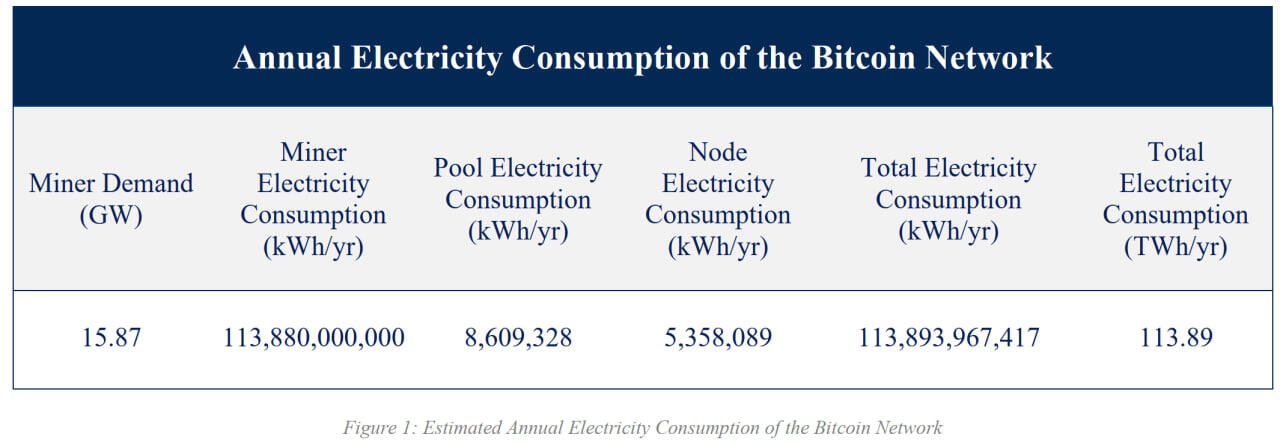

At the time of writing, the Bitcoin network consumes an estimated ~113.89 TWh/yr in total. To help contextualize this number, here are a few comparisons:

At the time of writing, the Bitcoin network consumes an estimated ~113.89 TWh/yr in total. To help contextualize this number, here are a few comparisons:

• The global annual energy supply is ~166,071 TWh/yr, 1,458.2x that of the Bitcoin network • The global annual electricity generation is ~26,730 TWh/yr, 234.7x that of the Bitcoin network • The amount of electricity lost in transmission and distribution each year is ~2,205 TWh/yr, 19.4x that of the Bitcoin network (based on World Bank and IEA estimates) • The energy footprint of “always-on” electrical devices in American households is ~1,375 TWh/yr, 12.1x that of the Bitcoin network

These comparisons highlight an important point: with basic assumptions, it is straightforward to estimate Bitcoin’s energy consumption in real-time.

Bitcoin’s energy usage has become an easy target for criticism. But this criticism raises the question: Bitcoin uses “a lot” of energy compared to what?

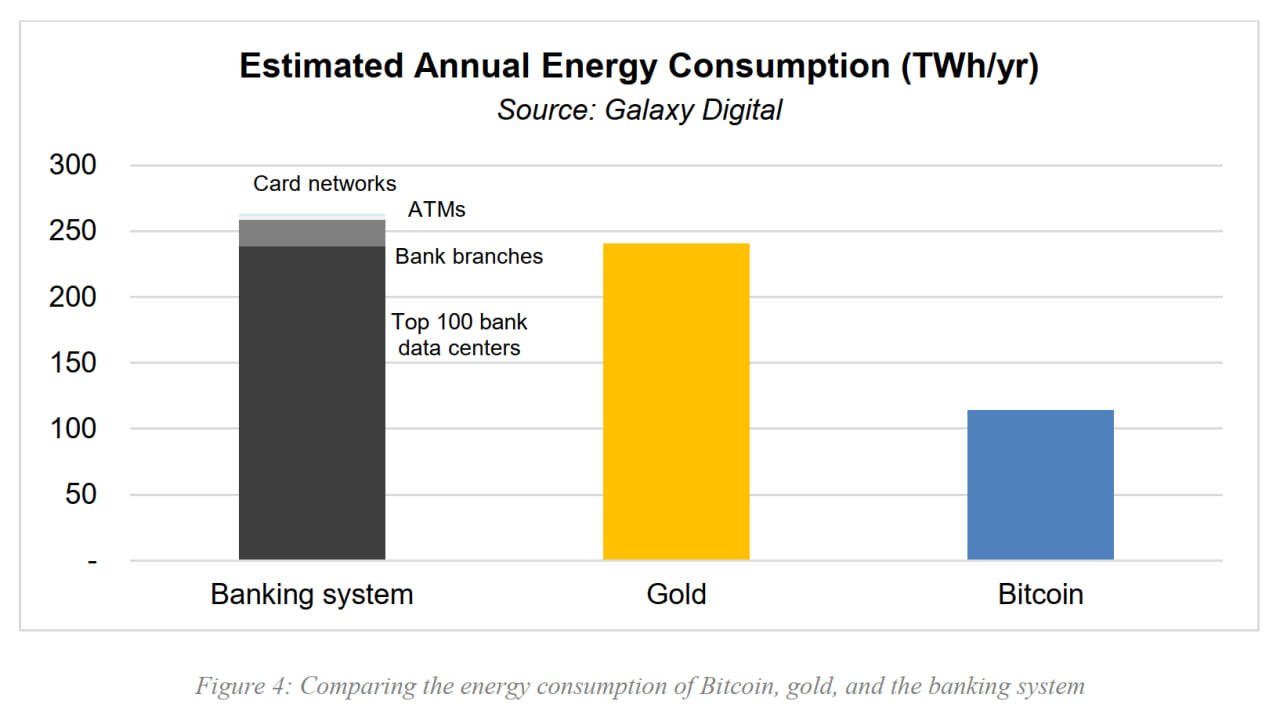

Bitcoin is most often compared to the traditional banking system (for payments, savings, and settlement) and gold (as a non-sovereign store of value). But Bitcoin is a fundamentally novel technology that is not a precise substitute for any one legacy system.

Bitcoin is not solely a settlement layer, not solely a store of value, and not solely a medium of exchange. Unlike Bitcoin, the energy footprints of these industries are opaque.

To have an honest conversation about Bitcoin’s energy use, a comparison to the most analogous incumbents—the gold industry and the banking system—is appropriate. Unfortunately, gauging the energy use of these two industries is not as easy as auditing Bitcoin.

What follows is a good faith effort to estimate the energy footprint of both the gold industry and the banking system. Since public data on the energy usage of these sectors is scarce, the methodology created for this research has been open-sourced and can be found here—we encourage others to review.

Summary of the Banking System Energy Usage

Electricity data for the banking industry is scarce. With the publicly available information that we could find, we estimate the banking system uses 263.72 TWh of energy each year. Deriving a comprehensive number for this sector’s energy consumption would require individual banks to self-report.

Even in aggregate, a comparison between Bitcoin and the layers of the banking system is inherently flawed. The traditional financial stack is a complicated hierarchy of ounterparties and intermediate settlement. Credit card networks are great for exchanging fast payments and IOUs, but they depend on the banking system for settlement, and the banking system in turn depends on central banks for final settlement, which in turn depends on the dollar system as a whole.

In the interest of scope, we have excluded central banks, clearinghouses (like the DTCC), and other aspects of the traditional financial system from the above analysis. It is important to note that this audit is only a slice of the entire system - the overall energy usage of the banking system is unknown and externalities are excluded.

Defining the banking system’s utility by its energy usage is reductive - overlooking the benefits of transferring large quantities of money. While it may seem practical to compare the banking system and Bitcoin on the number of transactions they process, the two have different scaling properties. The banking system scales with transaction count, requiring additional infrastructure as it grows. Meanwhile, Bitcoin’s energy consumption scales not by transaction count, but by network economics.

Sources

On Bitcoin’s Energy Consumption: A Quantitative Approach to a Subjective Question https://www.galaxy.com/insights/research/on-bitcoins-energy-consumption/ https://www.ourenergypolicy.org/resources/on-bitcoins-energy-consumption-a-quantitative-approach-to-a-subjective-question/

Financial Industry Electricity Balance https://github.com/GalaxyDigitalLLC/Financial-Industry-Electricity-Balance

Bitcoin network power demand updated every 24 hours https://ccaf.io/cbnsi/cbeci