Method 1: DCA

Do not underestimate the DCA, you buy very expensive but also very cheap, even starting the DCA at the highest price point. Even if you started on February 1, 2021 at a price of approximately 32000 and eating the two peaks up to 69000 now you would only have a -1.44% loss on your investment.

This is the recommended option if you don't want to complicate things.

Method 2: Cyph3rp9nk mode

To understand my method you must understand that Bitcoin is an inelastic asset, unlike gold. If there is a lot of demand for gold, gold production can increase because mines that were not profitable before are now profitable and also new mines are opened dampening the price increase because the supply grows. Conversely, when the price of gold falls, the less profitable mines have to close and the supply is reduced, thus cushioning the fall in price.

With bitcoin this does not happen, except in the halving that if the supply varies, the supply is constant regardless of the price, it can vary to the hashrate because if the price rises the number of miners will increase because at equal hashrate and price rise miners who were not profitable before will now be profitable and if the price falls at equal hashrate the number of miners will decrease because the less profitable miners will close, but the production is constant also regardless of the hashrate.

So what does it imply in the price that Bitcoin is an inelastic asset? that both the rises and falls are very steep because the supply cannot dampen the price either upwards or downwards. The method tries to avoid buying on the peaks and buy more on the troughs.

My method is about simple rules to follow.

I allocate a weekly amount for dca but I also have to maintain savings capacity to buy on the dips, so I can't bet it all on the DCA.

- Once the generational fund is obtained I make DCA whenever the price is below the previous high.

How do I identify the generational bottom? the weekly ma 200 is helpful, I consider that touching it is already a generational bottom.

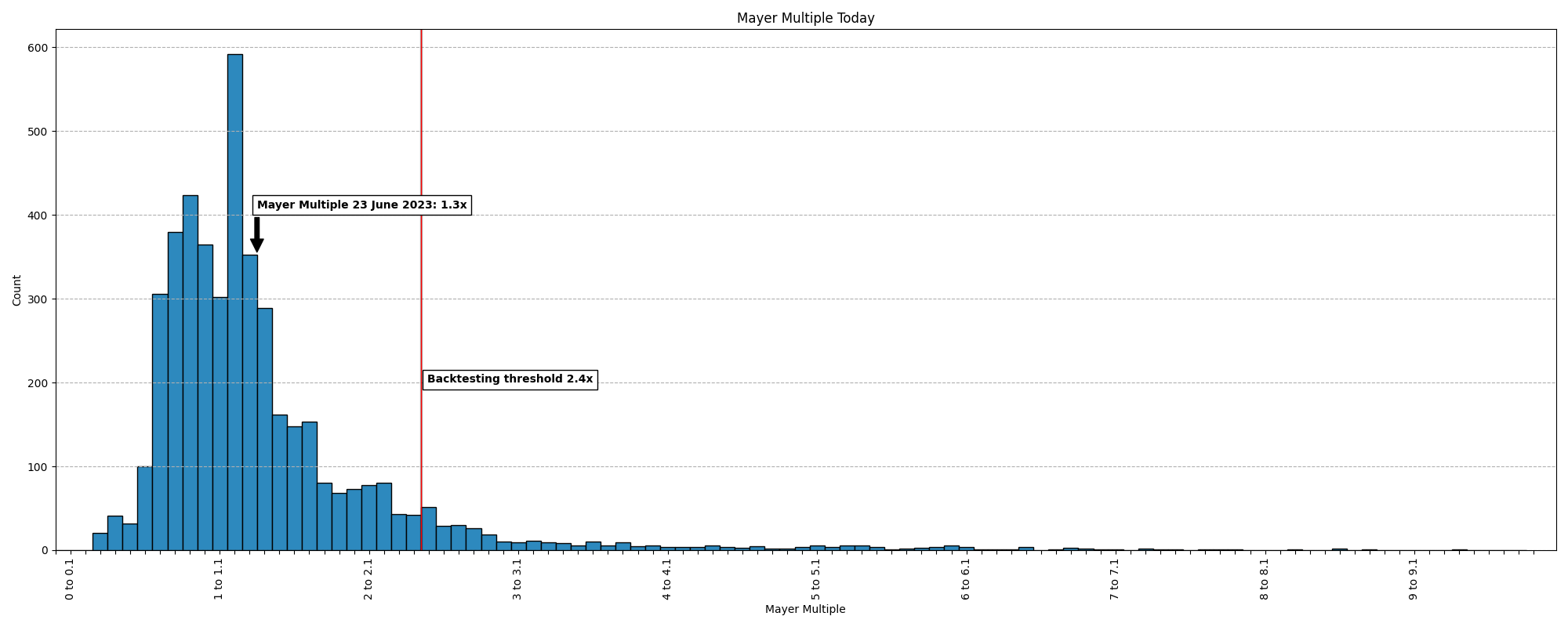

- When the price is above the high of the previous cycle I reevaluate the weekly DCA and only buy if there is not much distance between the daily ma 200 and the price, the histogram of the mayer multiplo will help you, I avoid buying in areas where the price has been a short time.

- I only restart my dca if the price gets close to the daily ma 200 again.

- If the price continues to go down and approaches the weekly ma 200 I start a downward dca entering with everything.

You may catch the floor you may not, don't worry, you will be buying more around the weekly ma 200 near the bottom and you will have avoided the peak.

As for the mayer multiple I am cautious above 1.5 and avoid buying above 2.