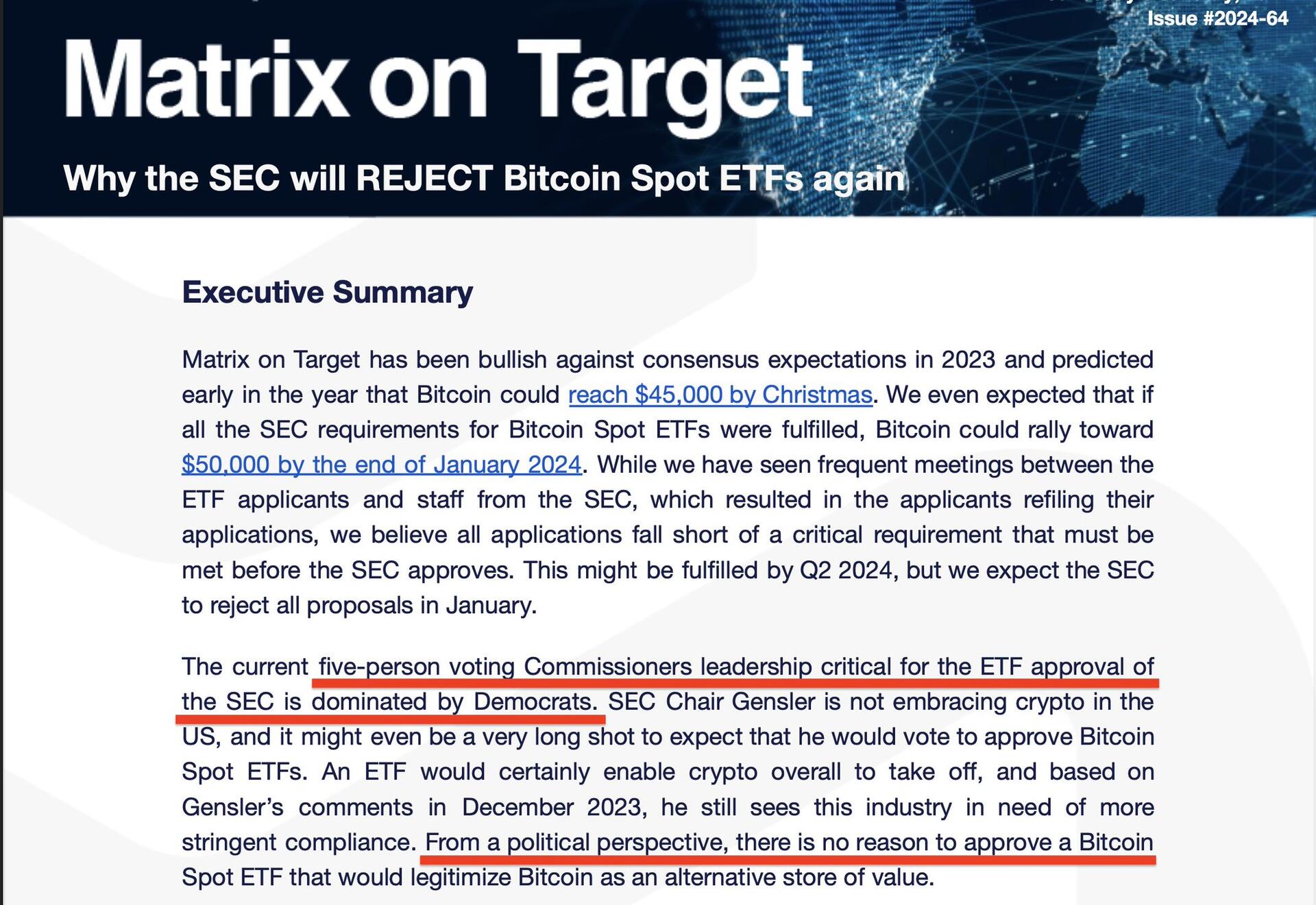

Their justification? Politics.

- 5 voting commissioners are Democrats.

- Democrats don't like 'crypto'.

- Applicants haven't satisfied the SEC's requirements.

- There is not political justification to approve a Bitcoin ETF.

I spoke to Bloomberg's ETF analyst @JSeyff at length, and together with his senior colleague @EricBalchunas - they give a +90% chance of approval due to a number of factors, especially the SEC's significant change in behaviour by way of engaging with applicants and providing them with guidance on updating their applications.

My interview with James is really worth listening to because we cover this from the outset and James lays it out quite clearly. It's worth noting James and Eric called Grayscale's victory in advance and have been accurate all the way along so far.

FULL BLOOMBERG INTERVIEW:

t.co/ASloefyIHF

There are several key reasons as to why a Bitcoin ETF is more likely to be approved this time compared to previous attempts:

1. **Grayscale's Legal Victory**: Grayscale winning its court case against the SEC has significantly shifted the landscape. This court decision has been a major catalyst in increasing the likelihood of ETF approvals.

2. **SEC's Increased Engagement with Issuers**: The SEC's proactive discussions and meetings with ETF issuers suggest a more collaborative and open approach towards resolving outstanding issues and concerns related to ETFs.

3. **Addressing SEC's Concerns**: Issuers have gradually addressed the SEC's concerns, ticking off many of the SEC's checklist of requirements for approval, such as 'Cash Creates' only.

4. **Market Evolution and Maturity**: The Bitcoin market has significantly evolved and matured over the years, with better infrastructure, increased institutional participation, and more robust regulatory frameworks.

5. **Improved Market Surveillance and Compliance**: Advances in market surveillance and compliance mechanisms have made it easier to address the SEC's concerns regarding market manipulation and fraud.

6. **Increased Institutional Interest**: Growing interest from established financial institutions in Bitcoin has likely played a role in pushing for regulatory clarity and ETF approvals.