Dollar goes up until something politically important in the US breaks; then Fed/Treasury add liquidity; dollar goes down, driving assets up…then inflation comes…then Fed tightens…then dollar goes up until something breaks…wash, rinse, repeat.

Perhaps US reshoring & winning in the long run requires discrediting USTs as global reserve asset to force a switch back to a neutral reserve asset like gold, & that seizing of Russian FX reserves may have been a US 4-D chess move in that direction.

Eurodollar liabilities (a.k.a offshore dollar liabilities) just serve as greater incentive for foreigners to sell the $7.6T in USTs they own to raise USDs, sending rates up until the 10y hits rates the US can’t afford, then Treasury/Fed step back in. Last fall suggests 5% on the 10y is roughly that level.

https://social.here.blue/media/cd53f8e4ea9e1753be5a11d4e00bf06b5094b3328a7a30d42072deb41651bad8.blob

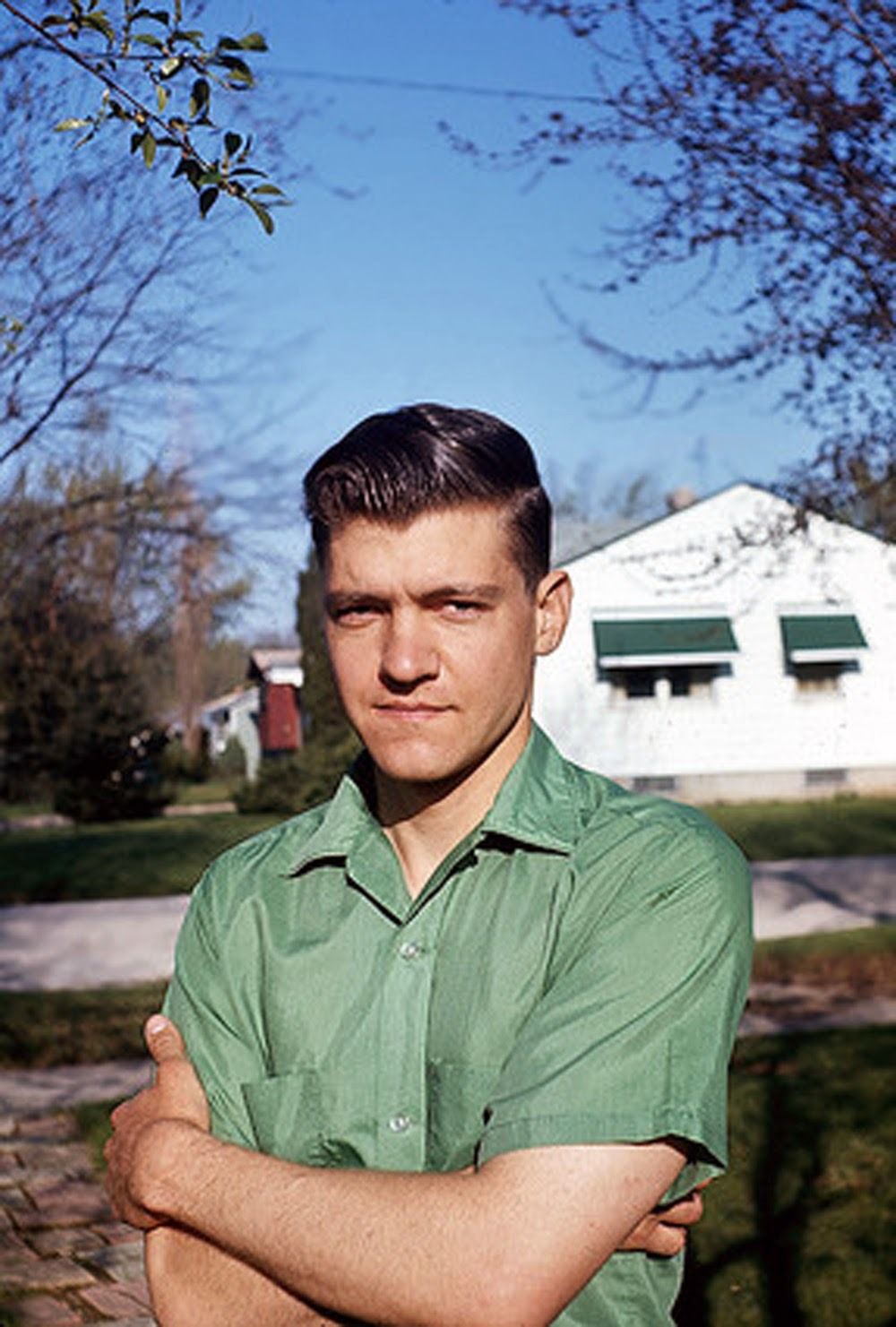

Theodore John Kaczynski /

npub1eg…k9zfr

2024-02-09 17:50:22

Author Public Key

npub1egvswnt7kelt7x9wew3sakuavpq8a4kg9leyp59xqfj5rwnayq2qgk9zfrPublished at

2024-02-09 17:50:22Event JSON

{

"id": "be87e3be15d433f9007908635f521a6134e9c547b2b6f040ee2e6ffa14d1176b",

"pubkey": "ca19074d7eb67ebf18aecba30edb9d60407ed6c82ff240d0a6026541ba7d2014",

"created_at": 1707497422,

"kind": 1,

"tags": [

[

"proxy",

"https://social.here.blue/objects/652e4448-b31a-41a5-9869-966d29042547",

"activitypub"

]

],

"content": "Dollar goes up until something politically important in the US breaks; then Fed/Treasury add liquidity; dollar goes down, driving assets up…then inflation comes…then Fed tightens…then dollar goes up until something breaks…wash, rinse, repeat.\n\nPerhaps US reshoring \u0026 winning in the long run requires discrediting USTs as global reserve asset to force a switch back to a neutral reserve asset like gold, \u0026 that seizing of Russian FX reserves may have been a US 4-D chess move in that direction.\n\nEurodollar liabilities (a.k.a offshore dollar liabilities) just serve as greater incentive for foreigners to sell the $7.6T in USTs they own to raise USDs, sending rates up until the 10y hits rates the US can’t afford, then Treasury/Fed step back in. Last fall suggests 5% on the 10y is roughly that level.\n\nhttps://social.here.blue/media/cd53f8e4ea9e1753be5a11d4e00bf06b5094b3328a7a30d42072deb41651bad8.blob",

"sig": "84a595092cb6d58acc1923c88a3d81512fa38e10b4467adbdd78e8b2a14ca78d1f202aa29aaf5cc7bb4b711bbbd9b1d724cce0c73eb9f86c7e35af685b4cb658"

}