A completely new market for energy efficiency arbitrage.

In this time when environmental sustainability has become a key word for industry, it is imperative to keep searching for innovations that might help any industry increase efficiency toward a greener goal. Balancing the electrical grid is an important way to manage electrical energy efficiently and finding a buyer for all produced energy is of utmost importance, especially the negative yielding energy! Bitcoin mining is an industry that will offer to buy waste energy worldwide, anywhere there is energy inefficiency. The sources for that energy surplus are places where kWh’s are wasted, or sold at negative prices. Arbitraging a positive price, any reasonable price, is what Bitcoin mining will offer. This efficiency will allow power plants to waste less energy, which means it will be able to consume less fuel, making it more environmentally friendly. Bitcoin mining will incentivize innovation in efficiency, this is the essence of sustainability. It will create a symbiotic relationship with energy providers.

Bitcoin mining uses non consumer energy, it is the buyer of last resort for energy. It has the ability to be this because it can be done at any scale, in any location. Consumers will always be willing to pay more for energy, so the first bidder is the consumer. If there is no bidder, Bitcoin mining will buy. It is a common misconception that Bitcoin mining will use energy that falls in the category of the consumer. Any form of energy will do as long as it is converted to electricity, because that is what the ASICs (application specific integrated circuits) that are used for mining, run on. ASICs hash, this is a function of computation done with a computer processor. Every block in the timechain (I prefer to call the Bitcoin blockchain a timechain) the Bitcoin algorithm produces a random number that needs to be found. In the case of the Bitcoin hash function, hashing is brute forcing that random number. The ASIC that finds that random number gets the block reward and the transaction fees, for all the transactions scheduled to be executed in that block.

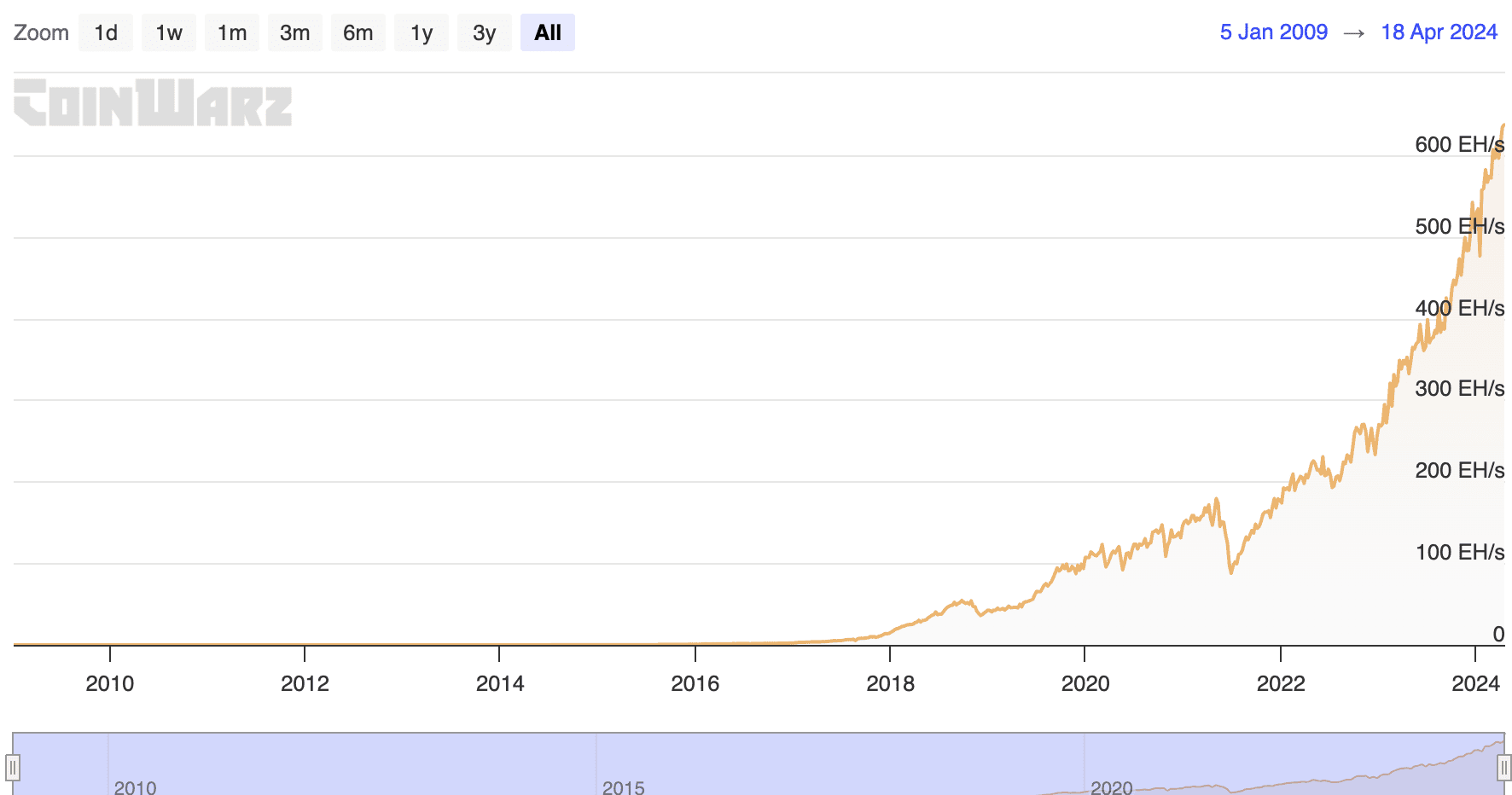

Bitcoin mining has a purpose to the Bitcoin network; Bitcoin mining is securing the Bitcoin network. As a reward, Bitcoin miners get paid in Bitcoin, as per block reward and in transaction fees. As the Bitcoin price rises it becomes more cost effective to mine Bitcoin, but as more miners come online to compete for the block reward and the transaction fees, it balances out. This isn’t really happening yet because there is a virtually unexplored market for energy that Bitcoin mining can become a buyer in. Just have a look at the hashrate (the total computing power of the Bitcoin network). There is no competition yet because the largest sources of energy that Bitcoin mining wants to tap into aren’t being explored yet.

Bitcoin mining, just like gold mining during the gold rush, is now in a discovery phase. Just like much of the American west was geologically unexplored for prospectors in 1848, most of the energy arbitrage market is now still unexplored by Bitcoin miners. It is a time of extreme opportunity, with great asymmetry in a market that is almost immediately tappable. A Bitcoin mine doesn’t require any infrastructure that doesn’t already exist anywhere, where there is energy: it is plug-and-play. From the outside it only looks like a shipping container, or several. Preferably it is positioned as close to the power source of choice as possible. It needs to hook up to the internet, so satellite works when there is no landline. A Bitcoin mine can be turned off at any given time, the cost of the hardware is marginal after amortization. Most of the running cost is in the electricity it uses, and most of the amortization is in the active use of the hardware. A Bitcoin mine can be switched off the minute efficiency requires it to. This makes it perfect for power plant grid management. A Bitcoin mining company is an energy arbitrage company, it buys energy and it has no customers. The revenue is in Bitcoin and the exchange rate determines its profit margin.

Another thing can be seen in the graph, see the dip in 2021? That is when China decided to ban Bitcoin mining. See what happened next? The miners moved their gear elsewhere and started mining again. Bitcoin mining does not rely on jurisdiction, operations can be moved relatively swiftly if needed. This also means that if it is more optimal to upgrade ASICs, it can be done quickly.

The 2024 halving at block 840,000 will cut the block reward in half from 6.25BTC to 3.125BTC. This means that it will become half as rewarding to mine, with the same hashrate as before, overnight. Where the issuance was 900BTC per day before block 840,000, after the halving that amounts to 450BTC per day. When the Bitcoin price corrects for this instant supply shock gradually, much of the disadvantage will be mitigated. Just look at the graph again and see that the hashrate has been moving up exponentially regardless of halvings. That is because there is plenty of electricity that has no buyer that needs to find a buyer in the form of a Bitcoin mine. And because price corrections, Bitcoin becoming more expensive nominally, motivate miners to keep mining. This market is the biggest unexplored market the world has ever seen.

Some calculations. The current hashrate is 615EH/s. A typical S19 ASIC delivers 140TH/s, the network is operated by many different kinds of ASIC’s. Not every one of them is as efficient. It is estimated that the total power consumption of the Bitcoin network in April 2024 is 20GW. If that number was represented sheerly by S19’s, the network would be operated by approximately 6.6M S19’s. Acquiring that number of ASIC’s including the infrastructure would cost approximately $30B. So to acquire a 1% share of the network that delivers 450BTC in total per day would cost $300M and would generate 4.5BTC per day. At the current Bitcoin price of $70k that would mean a $115M annual return. At 6% interest the annualized ROI would be 539%. Adjusting for a doubling of the amount of miners in a year, there would be a diminishing return of 50% spread out over 365 days. But adjusting for future Bitcoin price, even though speculative, would largely make up for that at face value.

It is now time to explore this market.