We know the banks have massive unrealized losses on the balance sheet, primarily due to treasury bond holdings.

However, if we continue to see CRE prices decline and CRE delinquencies rise, the banks will realize some big losses. Banks are the largest holders of CRE debt. This could lead to a continued banking crisis, like we saw last year.

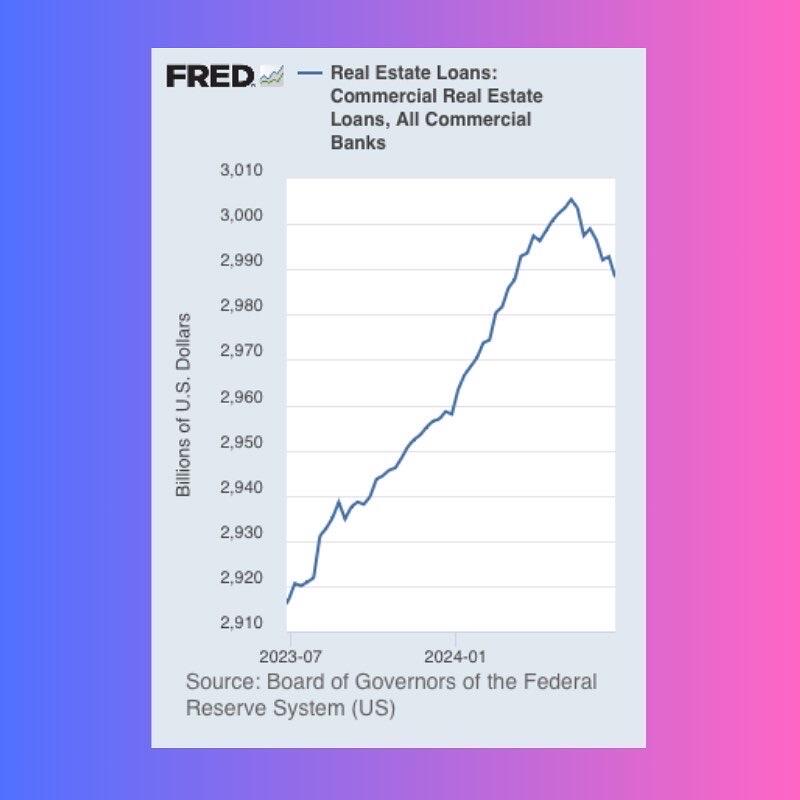

Chart 1: This chart shows the CRE loans held by commercial banks.

Since May 2024, we’ve started to see these holdings decline. There is word that commercial banks are quietly looking to ditch some of these bad CRE loans as damage control.

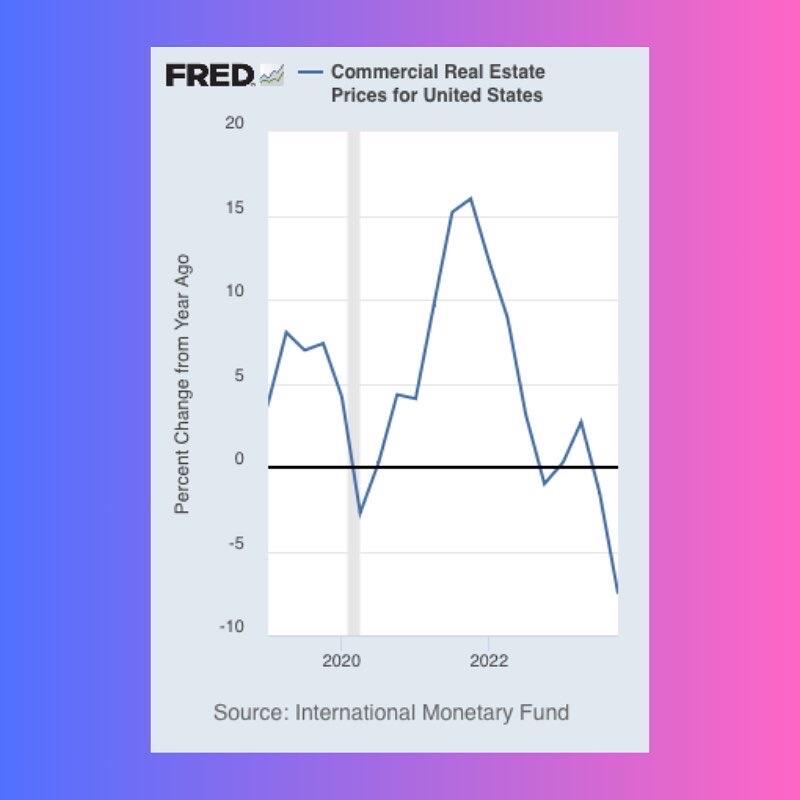

Chart 2: This chart shows the YoY percentage change in CRE prices.

Unfortunately, the latest data on this chart is Q4, 2023. CRE prices fell 7.53% from Q4, 2022 to Q4, 2023. I’d suspect that they’ve continued to decline in the first two quarters of 2024 as office space vacancies have continued to rise.

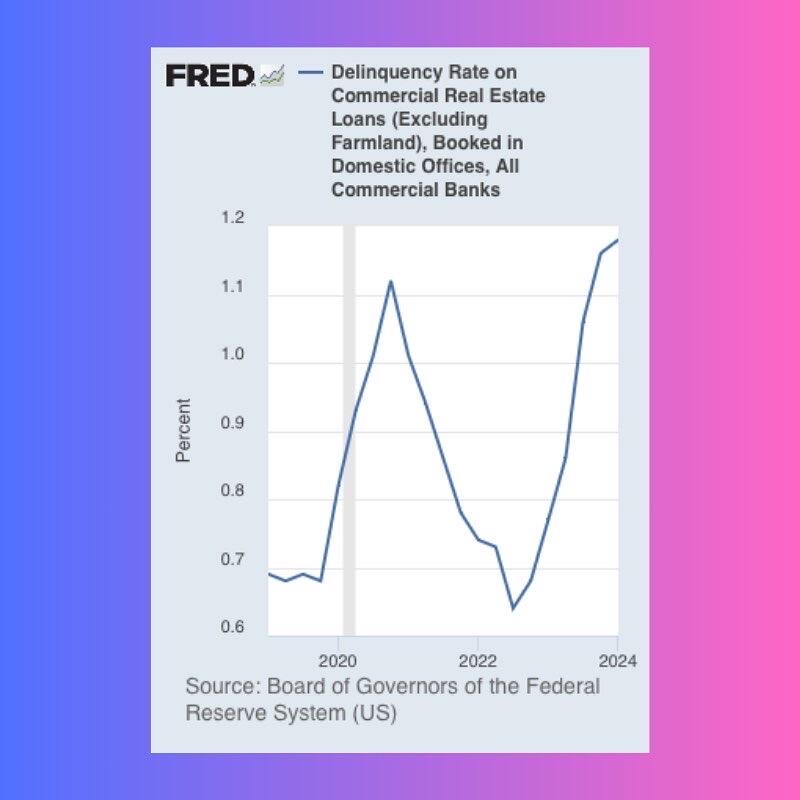

Chart 3: This chart shows the delinquency rate on CRE loans.

While we are nowhere near the delinquency rate levels we saw during the global financial crisis (2008), CRE delinquencies have been steadily rising since Q3, 2022. In Q1, 2024, we saw the delinquency rate on CRE loans rise to 1.18%. This is higher than the peak of 1.12% we saw in Q4, 2020 following the covid pandemic.

If we see these trends continue, it could be Bad News Bears for the banks.

These charts are from the Federal Reserve Bank of St. Louis (FRED). Reminder, this data is not 100% perfect, but I generally trust this data source.

Disclaimer: This is not financial advice, this content is created for entertainment purposes only.

#CRE #realestate #banking #debt